|

|

See also: The

Two Tiered Economic System

"Populism is Not a Style, It's a People's Rebellion Against Corporate [and Economic] Power"

Rebellion in Germany — Salute to the Strength of the German People

“We have lost faith in the

government until they prove that their politics

is for the people and not for the corporations.”

French Resistance Hero Stéphane Hessel

—

Call to a Peaceful and Non-Violent Insurrection

The following article offers a complete explanation of how our money and credit system is rigged to bankrupt the American people no matter how frugal, temperate, hard working, or budget-conscious they may be. — the editors

Rise People Rise

—

The Global Revolution is Upon Us!

Tunisa

—

The Sacrifice of One Man that Sparked Regional Revolution Against

Economic Injustice

Ireland

—

The Revolt Against the Elites Has Started

Why Zionist-Governed America Hates Hugo

Chavez

Br. Nathanael Mandate for America

2011 —

Ending Judaic Rule

"8/2"

Usury wins a Legislative Victory on the Day a

National Movement that will Kill

Usury is Born

Richard Eastman

August 2, 2011

"8/2" provides a complete explanation of how our money and credit

system is rigged to bankrupt the people no

matter how frugal, temperate, hard working, or budget-conscious they may

be.

"The marvel of all history is the patience with which men and women

submit to burdens unnecessarily laid upon them by their governments."

—

Washington

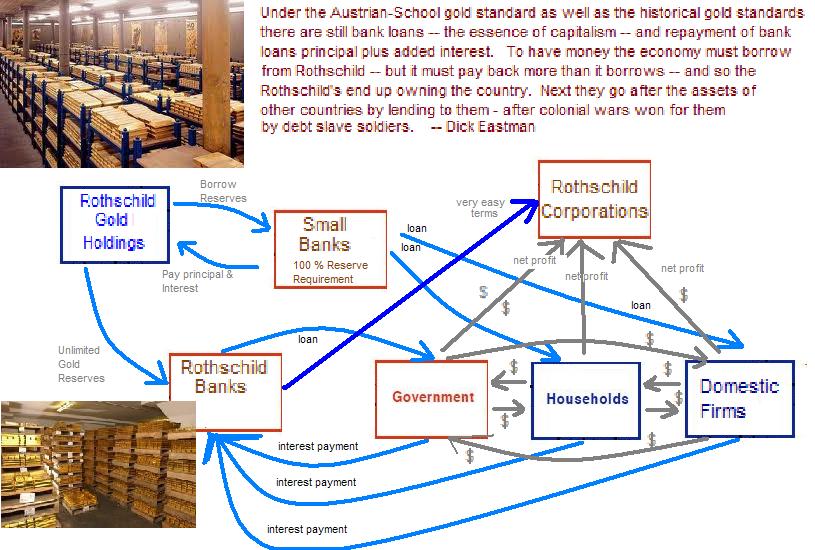

What we have witnessed today is the erasing of the US economy by the Rothschilds.

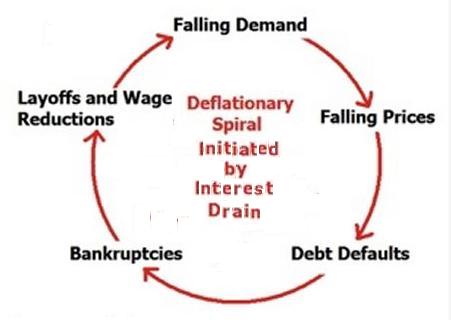

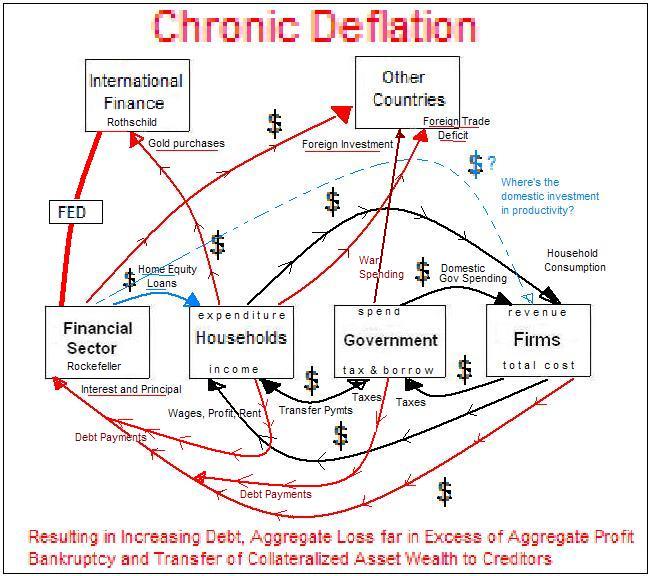

The cuts are only the beginning of the great contraction that will now happen -- the vicious circle of deflation that now will suck away the last of our vital purchasing power.

The Federal Spending Cuts are less than 20 percent of the cut to American spending and wage paying and debt paying power that will result from "8/2."

People get less pay from government due to the cut in expenditure, which means that less money will be in circulation -- because the government is going to pay the extra money it will be taking to the financial sector which no longer likes to invest here. Less fewer paychecks mean less is deposited into household and domestic business checking accounts -- which means banks will have less money in their vaults, which means they will have less reserves that enable them to keep loans outstanding. With less money and less fewer deposits and less fewer reserves the banks will have to call in loans and issue fewer loans and smaller loans -- and this in turn will mean another round of less money and smaller deposits and smaller reserves forcing another round of calling in loans.

Everyone will be affected.

Remember -- the economy has been rigged so that it is impossible for all Americans to meet all their loan obligations. Why? Because all of our money is loans. All of our money has to be paid back to the lender plus interest. But the lender -- the financial sector -- did not give extra money for the paying of interest.

They disparage fresh purchasing power by calling it "stimulus" and "inflation" while they keep from you the truth that the real killer is compound interest charged upon all the money we use.

|

|

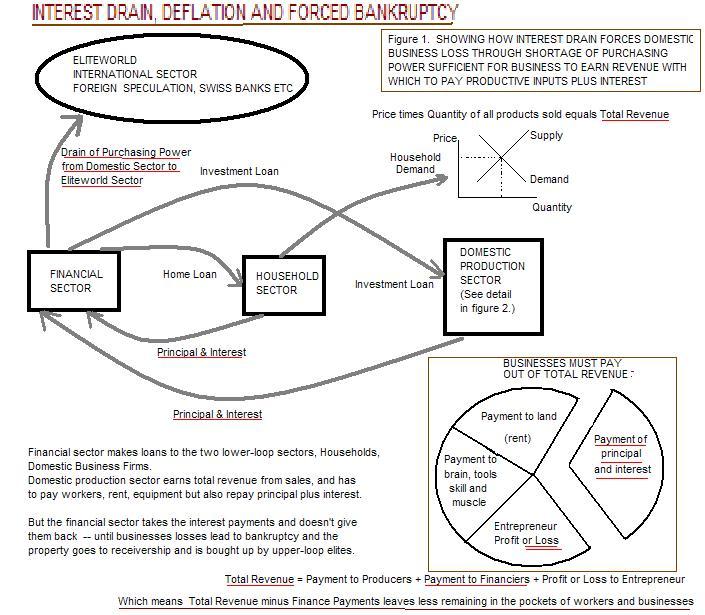

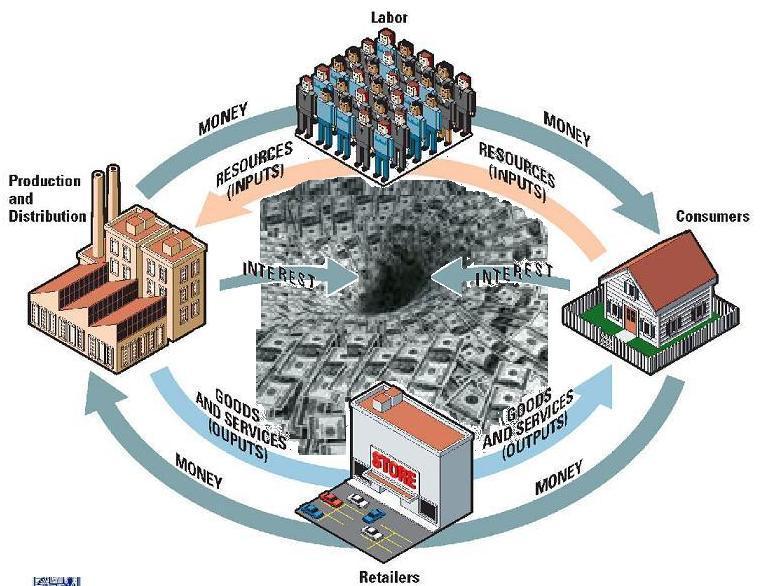

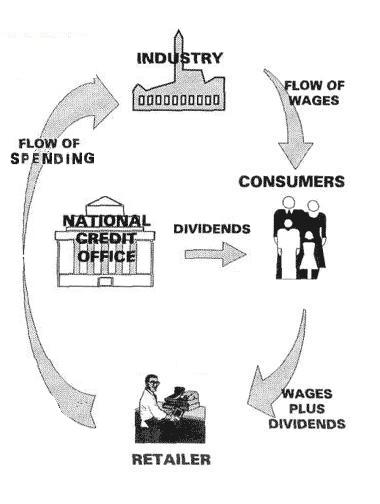

Money flows in and is it grows through the money

multiplier effect, but then it flows out as principal is repaid and

money in circulation contracts by the same money multiplier effect but

then there is the drain of interest - also intensified by the (negative)

money multiplier effect. It is the interest that sucks assets away from

the household and domestic business sectors to the financial sector and

the "pet" multi-national corporations that the financiers/speculators

own.

The Moneyed Elite want deflation in the Household and Business Loop for

two reasons. They make their money hiring out their dollars at interest.

The more deflation the more people are going to borrow. Also, each of

all the dollars they have owed to them is worth more in terms of what it

will buy when dollars are made more scarce. A 100 billion dollars in

circulation buys a one-hundred-billionth slice of the economic pie, but

when there is only a 50 billion dollars in circulation a dollar buys

twice that much economic pie -- and debtors have to work twice as hard

to earn each dollar that repays the loan.

"8/2" is the end. You listened to the media who gave you two phony

analyses of what was happening -- and a phony choice for each wrong

analysis. In the end the Money Power got what it wanted -- and I am sure

Senators were aware that Rudi Gullinani was on TV hosting a showing of

the movie with the world famous line that is understood all over the

world, "Make him an offer he cannot refuse." The timing and the message

were all too obvious.

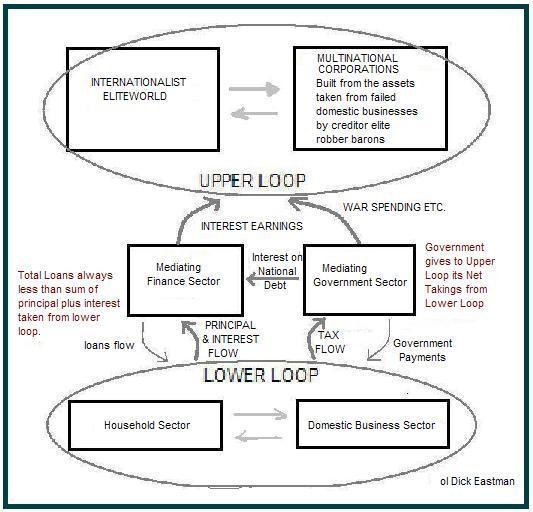

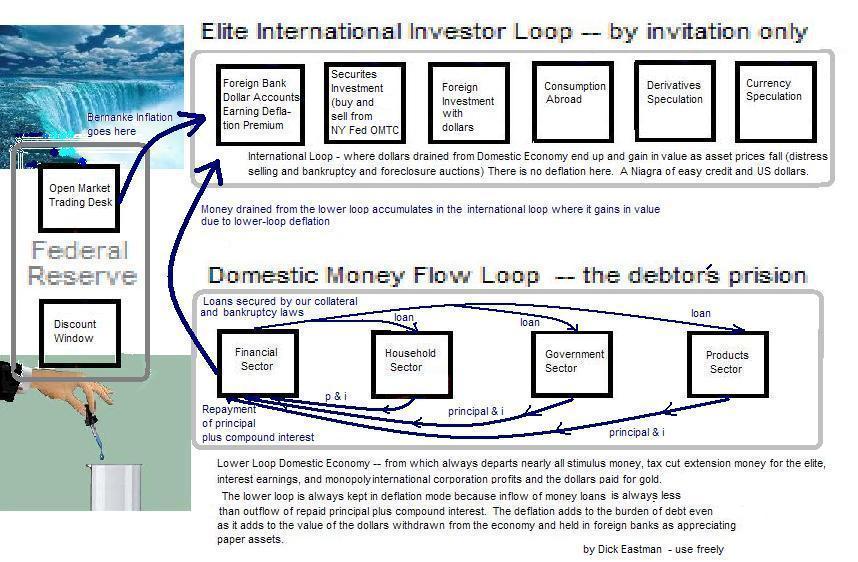

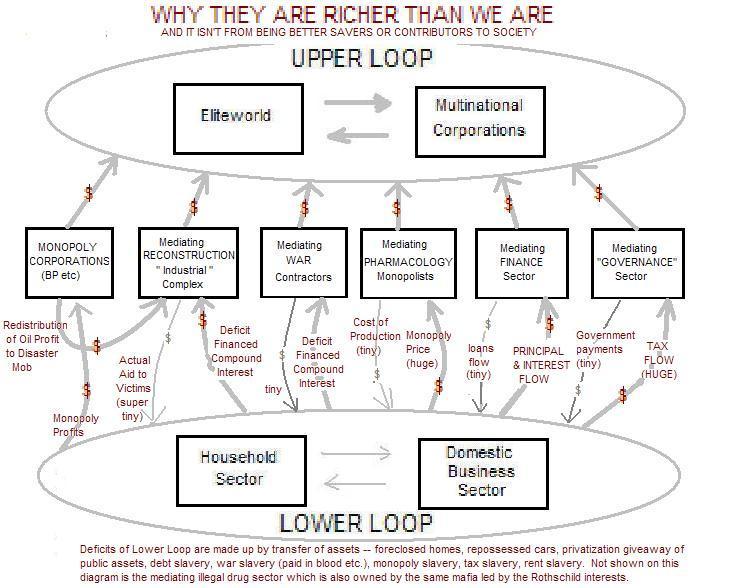

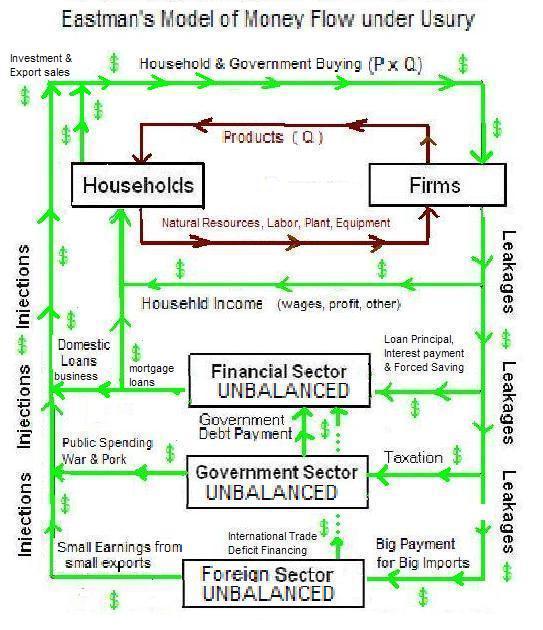

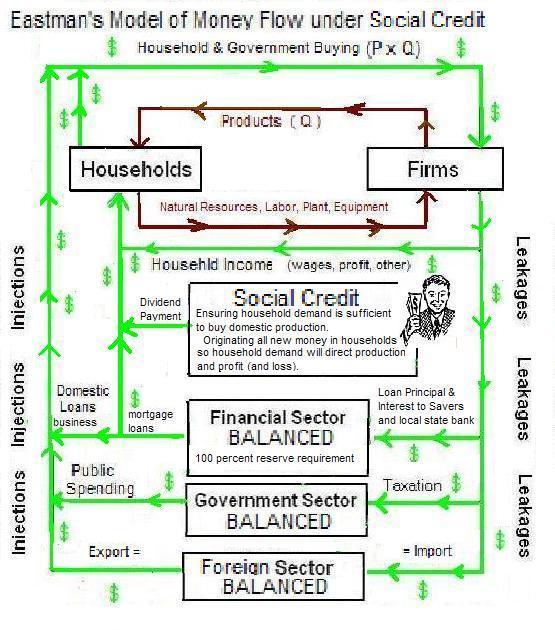

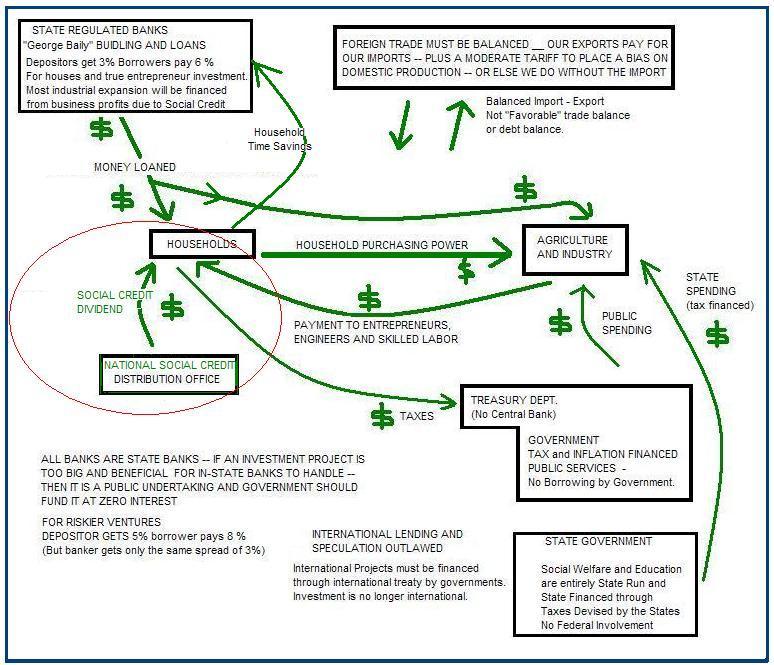

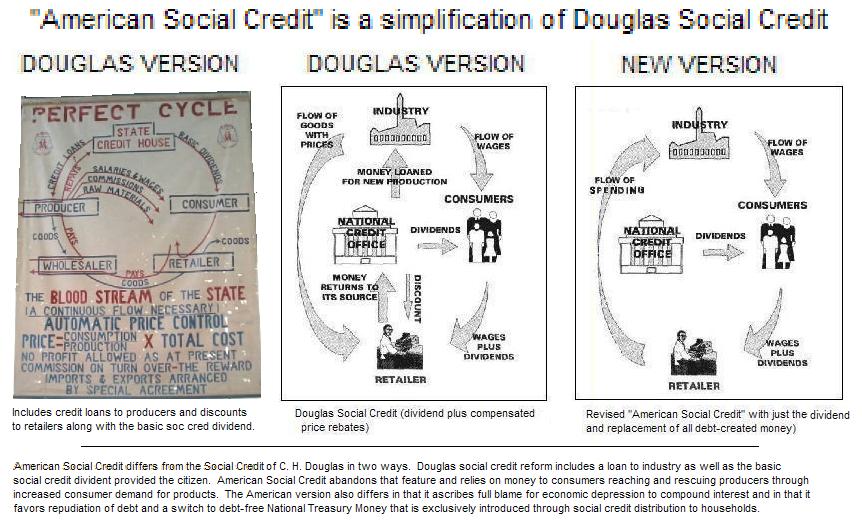

Diagramatic Explanation of the Current "Two Loop" Economy with its net

drain of interest from the household, pubic and production sectors and

the system of social credit and national "thin air" US treasury money

that replaces this system with plumbing that does not leak interest.

|

|

There are Two Loops

|

|

The Upper Loop are the Elite who enjoy easy money and a boom (inflation) outside the domestic economy because they are creditors receiving interest payments.

The Lower Loop are the Domestic Household, Production and Public Sectors who must borrow their purchasing power but must pay back that amount of principal plus a percentage more in interest. The money to pay interest is not created by the loans -- therefore the household sector must lose its real assets -- home, farm, business, car or whatever else you've got to pay your debts.

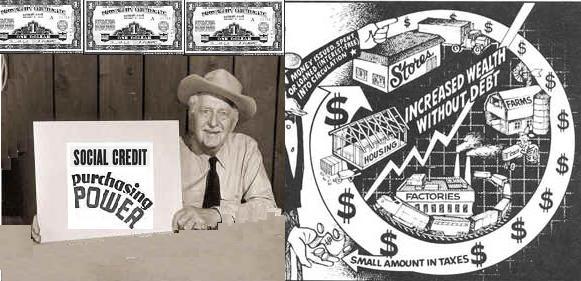

This is American Social Credit:

It takes us from here:

And puts us here:

American Social Credit

— Schematic of a Proposal:

* * *

A Youtube Presentation

Social Credit

and the Menace

of the Financial Sector

A

AMERICAN POPULIST LIBRARY

Why Do We Need Monetary

Innovation?

If Money Rules the World - Who Rules Money?

Irving Fisher

The Debt-Deflation Theory of Great Depressions

Arthur

Kitson

The Money Problem

The Fraudulent Standard

The

Money Problem

Money Question

Preface

Social Credit

(1924)

I.

STATIC AND DYNAMIC SOCIOLOGY

* * *

Questions and Answers:

https://www.thespiritualun.org/socialcredit.htm

* * *

Readings for all who choose to lead the

nation on this issue.

Margit Kennedy

https://www.margritkennedy.de/index.php?id=105&ord=56

https://www.margritkennedy.de/index.php?id=115&ord=57

https://fraser.stlouisfed.org/docs/meltzer/fisdeb33.pdf

https://www.yamaguchy.com/library/kitson/kitson_index.html

https://www.yamaguchy.com/library/kitson/kitson_index.html

Prefaces

Factors

Wealth

Exchange

Value

Standard

Purchasing Power

Money

Gresham’s Law

Existence

Price

General Rise

Money Supply

Credit the Cause

Rational Banking

Interest

Conclusion

Fraudulent Standard

Introduction

Great Crisis

War Loan

Exchange Value

Determines Values

Variability Gold

Peel Fallacy

Functions of Money

Invariable Unit

Money Supply

People’s Credit

War Financed

Free Trade

Summary

No-Money Island

Clifford

Hugh Douglas -

https://douglassocialcredit.com/resources/resources/social_credit_by_ch_douglas.pdf

or

https://www.mondopolitico.com/library/socialcredit/toc.htm

II.

INDUSTRY - GOVERNMENT OR SERVICE?

III.

THE

RELATION OF THE GROUP TO THE INDIVIDUAL

IV.

FREEDOM OF ASSOCIATION

V.

SABOTAGE AND THE CULTURAL HERITAGE

VI.

THE THEORY OF THE SUPREME STATE

VII.

THE

NATURE OF MONEY

VIII.

THE COMING OF POWER

PART

II

I.

THE

WORKING OF THE MONEY SYSTEM

II.

THE

NATURE OF PRICE

III.

UNEMPLOYMENT - OR LEISURE?

PART III

I.

THE

STRATEGY OF REFORM

APPENDIX:

THE

DRAFT SCHEME FOR SCOTLAND

Thoughts of Douglas

(excerpts from his writings)

https://www.alor.org/Library/ThoughtsofDouglas.htm

Gertrude Coogan

Money Creators

(1935)

https://yamaguchy.com/library/coogan/coogan_01.html

Frederick Soddy

Wealth, Virtual Wealth and Debt

https://abob.libs.uga.edu/bobk/wvwd/

Anthony Migchels

Saving and Stagflation

https://realcurrencies.wordpress.com/2011/01/25/stagflation-explained-at-last/

Gold Revisited

https://realcurrencies.wordpress.com/2010/02/16/gold-revisited/

John Hobson

Imperialism

https://www.marxists.org/archive/hobson/1902/imperialism/index.htm

Underconsumption – An Exposition and a Reply

https://www.marxists.org/archive/hobson/1933/11/underconsum.htm

Henry George

The Crime of Poverty

https://www.historyisaweapon.com/defcon1/georgecripov.html

What We Stand For

https://www.grundskyld.dk/1-What-we-stand-for.html

PROGRESS AND POVERTY

https://www.henrygeorge.org/pcontents.htm

A summary of Progress and Poverty

https://menaceofprivilege.com/synopsis-of-progress-poverty/

Ignatius Donnelly

The American People’s Money

https://yamaguchy.com/library/donnelly/donnelly_01.html

Hank Monrobey

Fisher's Incomplete Formula

https://www.het-klankbord.vuurwerk.nl/mistake.htm

Finance Environment

Enjoys Inflation Boom

absorbed through

Deflation Bust in the

Households-Production-Government Environment

https://www.het-klankbord.vuurwerk.nl/mistake9.htm

Where did all the money

go?

https://www.colorado.edu/peacestudies/sustainable-economics/debt/archives/msg00562.html

John B. O'Donnell

Three Steps to Economic Freedom -- Spend and Tax to Prosperity

https://www.geocities.ws/jackodonnell.geo/c00r4.html

The

ideas promoted in this message come from these great good people:

John C. Calhoun

Speech on Mr Webster's Proposition to Recharter the United States Bank, March 26, 1834 p. 138 of original

Speech on His Amendment to Separate the Government From the Banks Oct 3, 1837 p. 275 of original

Speech on the Bankrupt Bill June 2, 1840 p. 390 of original

On the Treasury Note Bill January 25, 1842 p. 463 of original

William M Gouge

A Short history of

Banking in the United States of America

-- with an Account of Its

Ruinous Effects

https://market.android.com/details?id=book-VtIZAAAAYAAJ

An Inquiry Into the Expedience Of Dispensing With

Bank

Agency and Bank

Paper In Fiscal Concerns OF The United States

https://books.google.com/ebooks/reader?printsec=frontcover&output=reader&retailer_id=android_market_live&id=Y-9HAAAAIAAJ

https://market.android.com/books/authors/William%2BM.%2BGouge

Leo Tolstoy

What

Must Be Done?

https://www.arvindguptatoys.com/arvindgupta/whatthenmustwedo.pdf

Moral Progress through the Establishment of Public

Opinion

https://www.google.com/gwt/n?u=http%3A%2F%2Fwww.kingdomnow.org/2Fw-inyou10.html

Social Credit Together

Young people are worth more than the short and miserable future

Rothschild has planned for them.

https://www.alor.org/Library1.htm

Canada: Michael Journal — Louis Even Founder (Social Credit)

https://www.michaeljournal.org/articles.htm

American Social Credit

in search of a logo

(Richard Eastman)

https://www.thespiritualun.org/socialcredit.htm#Book_Report

https://www.youtube.com/watch?v=xRfOtrYhVx8

https://www.citizensamericaparty.org/index.htm

The world looks much better once it is realized that people have power

in unity

to break interest theft and debt slavery once and for all.

British Social Credit

Murial Mobley

Belief: Faith in Experts, Authorities, and Gurus

Information That May Disturb Your Beliefs

Economic Possibilities Without Financial Limitations

Quotes - Collected by Muriel Mobley

Rev: J. Martin Hattersley

Frederick Soddy and the Doctrine of Virtual Wealth

Hattersley's Course in Social Credit

I – The Principles of Government

VI – Some “Orthodox” Solutions

VII – The Views of the Reformers

X –

The Social Credit Movement

Arian Nevin

Did a Nobel Prize Winning Chemist (Soddy) Discover a Solution to the Economic Crisis?

The Government Doesn't Want to Solve the Economic Crisis

The Money System Bankrupted GM

The Economic Evil Gripping Our Nation

The Cause of the Great Recession

The Still Unsolved Problem of the Economy

The Money System is a Confidence Trick

Frederick Soddy - Revolutionary Scientist

National Economy - The Scientific Solution

"Unless Parliament

interferes, the whole of our British banks will be under the control of

a single board of directors within the next twenty years - if not

sooner. And this Board will have no responsibilities to any but it's

depositors and shareholders! I cannot imagine a more dangerous

menace to the public interests!

... To leave this entirely in the hands of men whose duty is first - if

not last - to heap up profits for a few shareholders, is, from the

national standpoint, almost suicidal. " -- Arthur Kitson, Preface

, A Fraudulent Standard October 1917

You think the gold standard is the answer?

Think Again.

Testing Claims for Gold

Proposition: "Only gold keeps its value."

Objection: Paper under the right conditions keeps its value. Government paper money passed in circulation without depreciation, performing perfectly the function of medium of exchange, reliably quantifying the exchange rations among goods and services and serving as a measure and standard of deferred payment.

Objection: All of the great panics and business crises the post War Period occurred on the gold standard. Even the great depression occurred on the gold standard. According to William Stanley Jevons, between 1789 and 1809 the value of gold fell 46 percent; from 1809 to 1849 it rose 145 percent; from 1849 to 1874 it fell at least 20 percent.

Contention: With gold to obtain an addition to supply of two tons from gold mining operations costs about twice the expenditure for finding and digging as would a supply of one ton. In contrast, with paper money politicians can print a thousand dollar bill as cheaply as a one dollar bill and being tempted all the time to buy votes legislate "pork" contracts for their friends and being in charge of government spending they can't be trusted not to spend. Therefore there is a natural constraint on the growth of a gold money supply that is lacking with paper money.

Objection: The variability of the supply of gold entering the commodities/precious metals market does not come from gold discoveries. Gold is hoarded in vaults. The owners of this gold reintroduce it or withdraw it when it is profitable for them to do so. Rothschild adds and subtracts gold from international markets with as much ease and small expense as checking deposit loans are created by strokes of a keyboard.

Objection: If a politician wants to spend large amounts of government money in his state and other politicians are not disposed to stop him, a gold standard will not stop him. While he won't be able to print up the dollars needed, he can borrow gold from Rothschild at interest and with the gold the government could then print the gold certificates to pay for the project. Note that the government is paying interest to Rothschild -- it is not paying the cost of mining the amount of gold in question. So we see again that inflation and speculative booms do occur under the gold system. In fact it is more than likely that a politician as in our hypothetical example would be an agent of the Rothschild gold-lending business.

Objection: In ancient Sparta Lycurgus created a society in which gold and silver of Egypt and Persia were banished and lead was the coin of the realm. The Spartan lead coins circulated with undiminished value against the gold and silver coin of other nations for a hundred years. Source: Plutarch's Lives (trans Dryden and Clough) https://www.constitution.org/rom/plutarch/lycurgus.htm or https://www.e-classics.com/lycurgus.htm

Conclusion: The contentions that gold maintains its value and is free from manipulation is absurd. It is every bit as subject to manipulation as is "paper" money or "thin-air" loan checking accounts. Rothschild can add or subtract gold from the monetary base of a gold system thereby causing a swelling or shrinking of available purchasing power -- with or without a fractional reserve system. (Without a fractional reserve system you will just have to borrow more gold from Rothschild to get the purchasing power required.) Rothschild does not hoard gold merely to have it. The purpose of his gold is to go out and come back bringing interest and other peoples' foreclosed assets with it.)

Further comment: Social Credit provides the safeguards against special-interest political spending that gold says it guards against but does not. Under a social credit fiat money system, politicians to not decide how new money will be spent and Rothschild is not the source of new money. Rather, under Social Credit it is always the case that all new money originates as even distribution to each citizen, that is, the new money originates free and clear (not a loan) and in equal amount in each household. There can be no special interest who "first-spender" windfall gain being the first spender because he got a loan or a government contract. With social credit the economy is, for the first time, run by household demand -- a system of true consumer sovereignty -- an every undertaking is done with minimum of expense since money is so plentiful that everyone can be hired to cooperate in the nations economy and all resources can be utilized to meet our needs and build what we dream. Gold is but a collar around our necks, a permission slip from Rothschild that must be paid before we can undertake to provide for ourselves.

Gold, in short has always been the traditional instrument of leverage in Rothschild international dealings.

And remember -- these days Rothschild has weaponized weather under secret control -- they create the disasters that require the budget-busting reconstruction that requires loans of Rothschild gold.

If any libertarian or "Austrian School" defender wishes discuss this further, you have only to click reply at the top of this page.

Dick Eastman

Yakima, Washington

Without the sound character of a nations people any kind of money will be pig dung.

_____________________________________________

Which shall it be? Von Mises or Major Douglas? (1) A privately administered gold standard -- or (2) Money tokens born free of thin air in the hands of each citizen with no requirement to dig it out of the ground, or obligation to pay it back with interest just to get it into circulation or lose your house or business when there are not enough tokens in circulation to service debt?

To Lew Rockwell and Gary North:

Suppose a libertarian congress and president are ready to adopt the gold standard.

They define the dollar as a weight of gold.

They require that dollars be exchanged for gold on demand.

They eliminate fractional reserve banking.

They require 100 percent god reserves for every loan.

They do not issue more money substitutes (gold redeemable certificates) than they have gold in the vault.

Now they turn to the task of putting gold or vault-gold-backed gold claims into circulation.

They mint the gold in Fort Knox and allow banks to swap out their paper FED dollars for gold bullion and coin.

If banks have gold to back their loans outstanding -- they let those loans continue.

If they lack the goal to back their loans outstanding -- they call in loans.

If they call in loans there will be a contraction of the money supply and deflation and everything that goes with a deflationary depression.

They can either let the deflation proceed as the market solution plays out or they can re-inflate the currency to stave off a readjustment.

They decide to allow deflation to take its course -- a pure market solution.

The nominal price of products fall due to the shift in nominal demand -- and so the nominal wage must fall or unemployment increase or a combination of lower nominal wage and lower employment and output.

The contraction will not be "neutral" because not all prices shrink together and some payment obligations -- interest and principal payments and taxes and fixed obligations will not drop. Markets do not adjust because of these rigidities. Labor contracts will eventually be solved by busting the unions or moving production abroad -- changing the minimum wage in a depression will be harder -- but it has been done. BUT INTEREST PAYMENTS AND TAXES THAT MUST BE IMPOSED FOR THE GOVERNMENT TO PAY ITS INTEREST WILL NOT ADJUST DOWNWARD EVEN IN THE MOST SEVERE DEFLATION.

So the president and congress look to credit as the way out.

Yes, there is a law that says all transactions must be in gold money -- that every loan must be baked by gold.

But what about a loan to a person of known good character and solid wealth who asks for a loan and promises to pay in gold when the time comes? There is not gold in a vault for this loan, but the man is known to be rich as Croseus and he is willing to give a note payable in gold at a latter date. Do you allow such a man to have gold certificate or not?

If you let him have it so he can speculate with it - you will be adding to the money supply and very imperfectly addressing the deflation/disequilibrium problem -- except that this man will first spend his fresh purchasing power on whatever he is speculating in -- and they will bet the benefit that first spenders have when they get to introduce the new inflation. It is the latter spenders who will lose -- this is a further source of disequilibration. You will also be making sure that only the rich can invest and get the advantage that inflation gives over the latter spenders who receive the new money only after it has lost purchasing power due to increased money claim supply.

In the end the gold standard will contract the economy and give the owners of gold the power to inflate or deflate as they choose -- the very thing that has happened with all gold standard systems in the past. The last thing gold will give will be a stable currency.

Now look at the social credit case.

Suppose the nation has no money and everything is barter.

OK, suppose next that someone figures that goods are exchanging in consistent ratios -- wheat for cloth, coal for nails etc. and that if one skeen of cloth exchanges for three baskets of wheat -- and if three baskets of wheat exchanges for three boxes of nails and three boxes of nails exchanges for four buckets of coal -- why not simply establish among everyone a token system so that five tokens buys either one skeen cloth, or three baskets wheat, or three boxes nails or four buckets of coal? That way when you have cloth and want coal you do not have to barter for wheat and nails to get your coal -- you take five tokens from the wheat man and go directly to the coal man and get you coal.

OK, so money is a good idea. But how do we get it started?

Ludwig von Rothschild, who owns the only gold mine, says -- "Let's make our tokens of gold. When you want tokens just come to me with your nails and your wheat and your coal and your cloth and I will give you my gold in exchange for it."

Oh, thank you, says Ron Beck-Celente -- that will be great? And so Rothschild gets a lot of wheat and cloth and nails and coal for the use of his money so that people can buy from each other whatever wheat and cloth and nails and coal do not belong to Ludwig von Rothschild.

But since Ludwig von Rothschild owns so much -- and there is so little left for other people to buy -- people start coming to Ludwig von Rothschild for loans -- and so Ludwig von Rothschild starts giving his gold away on conditions of full repayment plus a premium of extra gold called interest -- otherwise Ludwig von Rothschild is not "interested" in making the loan.

Now once Ludwig von Rothschild starts making loans and has all these I-owe-you-gold claims from everybody -- he thinks to himself -- I can make myself richer if I give out a lot less gold than I have been giving out. Then the gold people give me as principal and interest will be worth more in terms of purchasing power than the gold I gave them as a loan. So my lending will make me richer not only by interest but also by deflation. And of course if they cannot pay what they promised to pay I will take their cloth mills, their wheat farms, their nail factories and their coal mines which they have put down as collateral. I will own everything -- which is OK because God loves me to be blessed with all these good things and my family unto a thousand generations.

Well certainly God and Ludwig von Rothschild are pleased, and all the people who smile at everything Ludwig von Rothschild does and nod their heads at everything Ludwig von Rothschild says -- so they must be going along with this scheme of things too, right?

But then the town fool, Douglas Kitson-Soddy by name, speaks up. He says, "It seems to me that folks went about it the wrong way getting that money system started. By taking up Ludwig von Rothschild's offer to make the gold from his mountain the money we use we seem to be paying fore everything twice and then losing some when the value of gold changes because Rothschild cut the amount of gold he is lending making him richer because there are fewer pieces of gold in the hands of people to buy our wheat, cloth, coal and nails.

"What we should have done when we were setting up a money system was simply to print up some special paper -- cut it into squares and make them our trading units. We will make the unit small enough so that it can be used for buying and selling plentiful things or small portions of things -- and we can print numbers like 5, 10, 20, 50, 100, 500, 1000 and 10,000 and 100,000 for buying very big things like factories or farms or a new bridge over the Lollypop River."

The next day the mayor in an address at the Ludwig von Rothschild Center made reference to Douglas Kitson-Soddy's whacko money cranks, and the editors of the City Tribune and the Metropolitan Chronicle both reminded the people that paper is easy and cheap to make that it takes the same amount of ink to write a "3" as it does to write a "5" or a "9" or a "10" -- but that gold must be found deep in the ground in dangerous mines that take drills, and steel, and pumps, and timber, and picks and lots of labor and black lung disease -- which prevents people from too easily making all the money they want -- which would hurt everyone because prices would go up." Everyone of importance in the town nodded their heads and smiled for the mayor when they heard him -- and everyone who works for Ludwig von Rothschild, when they read the editorials, thought to themselves that it would certainly be very disruptive and harmful to change money systems at this late date.

But later that afternoon Douglas Kitson-Soddy, the town fool, told some people gathered around the park bench where he was sitting -- that the only way the money system could have been set up fairly was if on the first day, every citizen got an equal amount of money free of charge and just started using it. That way the right of being "first spender" of new money would be equally shared. That way no one would be owed for the use of the money. Because money is not a thing we consume or that we use to make things -- it is simply a way of reducing the amount of barter transactions we need to make by having purchasing power made abstract and fluid -- so that we can cooperate rationally in production -- and think in terms of numbers of price, and numbers of revenue and numbers of profit and numbers of wage -- not because the numbers themselves are valuable -- they are just an accounting system -- a means of rewarding people with abstract purchasing power that can be spent anywhere and on anything without having to barter to go from what you have to what you want. If we just would have passed out an equal number of purchasing power to each person -- and let each person set the price they are willing to pay for things and the price at which they are willing to sell things -- the system would work.

And if people do not want to use the paper system because they don't think people will value the paper -- then all that is necessary is that the mayor make it official that the taxes of the town can always be paid in units fo this paper money. That way the paper money will be valued by everyone as sure as there will always be, as they say, death and taxes.

To sum it all up, said Douglas Kitson-Soddy -- if people are bartering for goods and they want a fair money system that doesn't make the guy with all the gold become the guy who owns the planet -- the only way is to just pass out an equal amount to every participant in the economy and tell them to go spend it. That way the town will make cloth and nails and wheat and coal and many other things according as people decide that that is what they want to buy. And as the economy grows -- since people improve their businesses instead of paying interest and principal to Ludwig von Rothschild -- new money can be passed out regularly to everyone so that purchasing power will keep up with the great economic pie made of nails, cloth, what, coal, snips, snails, ships, shoes, sealing wax and cabbages and leashes for puppy dogs.

Dick Eastman

Yakima, Washington

Every man is responsible to every other man

Why we need AMERICAN SOCIAL CREDIT Immediately

https://www.youtube.com/watch?v=xRfOtrYhVx8

view full screen, pause youtube to examine the diagrams

Addendum

Note:

What is the Quantity Theory of Money?

John Kenneth Galbraith on the Quantity Theory of Money

https://www.youtube.com/watch?v=Jq66-0JLC8s

MV + M'V'

____________

P = T

P is the price level

M is the quantity of currency in circulation

V is the average number of times a currency dollar is spent per time period

M' is the total amount of checking account money in deposits

V' = average number of times a checking deposit dollar is transferred to another account per time period

T = Number of transactions per time period

The

nominal price level depends on the amount of pie put up for sale, the

quantity of tickets for a slice of the pie, and the number of times each

ticket gets spent during that time period.

Social Credit has been around for many years:

|

|

|

|

|

The Populist Choice |

|

Populist

Nationalist

Social Credit

Brotherhood

of American

Citizen

Peacemakers

of

All

Races

and

Creeds

—

This is our Common Ground!!!

Question and Answer

|

"You can't

print

money out of thin air in a time of recession attempting to bring

us out of recession without experiencing

inflation!"

"Yes, Gerald. That's right. And you can't come out of suffocation without

experiencing

inhalation! And what the heck is wrong with that! The economy is

in a lower-loop DEPRESSION because lack of means to pay interest

and maintain household demand which keeps us employed and fed.

That is deflation. You end deflation by inflation. Inflation is

good. There is never economy recovery without a gain in

purchasing power applied to increasing effective demand. And,

let me add this: Inflation never leads to depression. It is

always debt and the interest payments resulting from debt that

drain purchasing power. If we government really used a printing

press and spread dollars around -- instead of borrowing all of

its purchasing power from Rothschild or taxing the people the

money that the people have gotten from borrowing from Rothschild

THEN THERE WOULD NEVER BE DEPRESSIONS. Finally, rising prices

will be consistent with increasing household purchasing power

and rising standards of living as long as wages rise apace --

and wages will rise apace as long as businesses are getting

strong demand for their product that is not hollowed out by

having to pay big interest payments. |

|

George Washington, |

|

Because We Remember Our Our Roots:

The Hype About Inflation and Gold